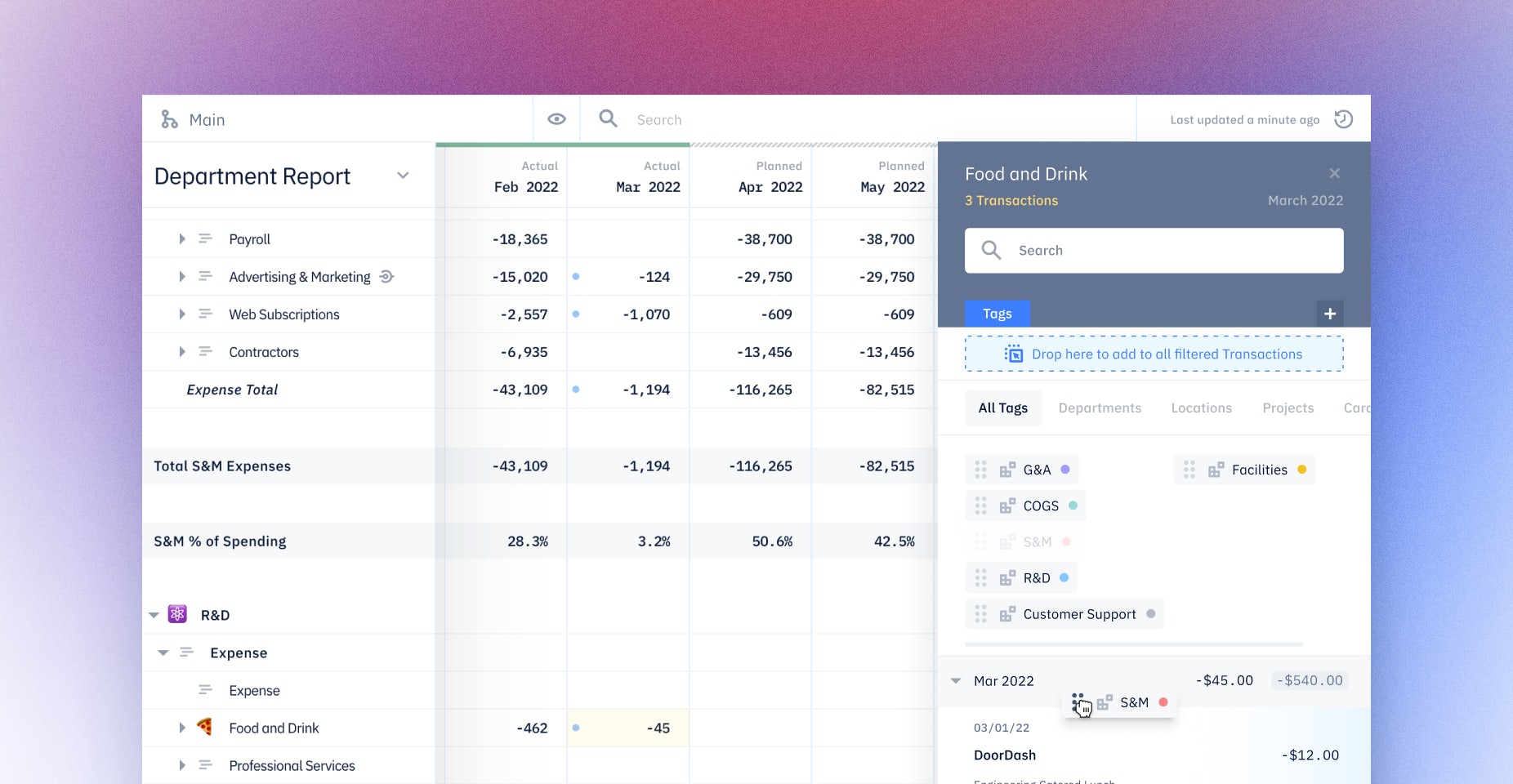

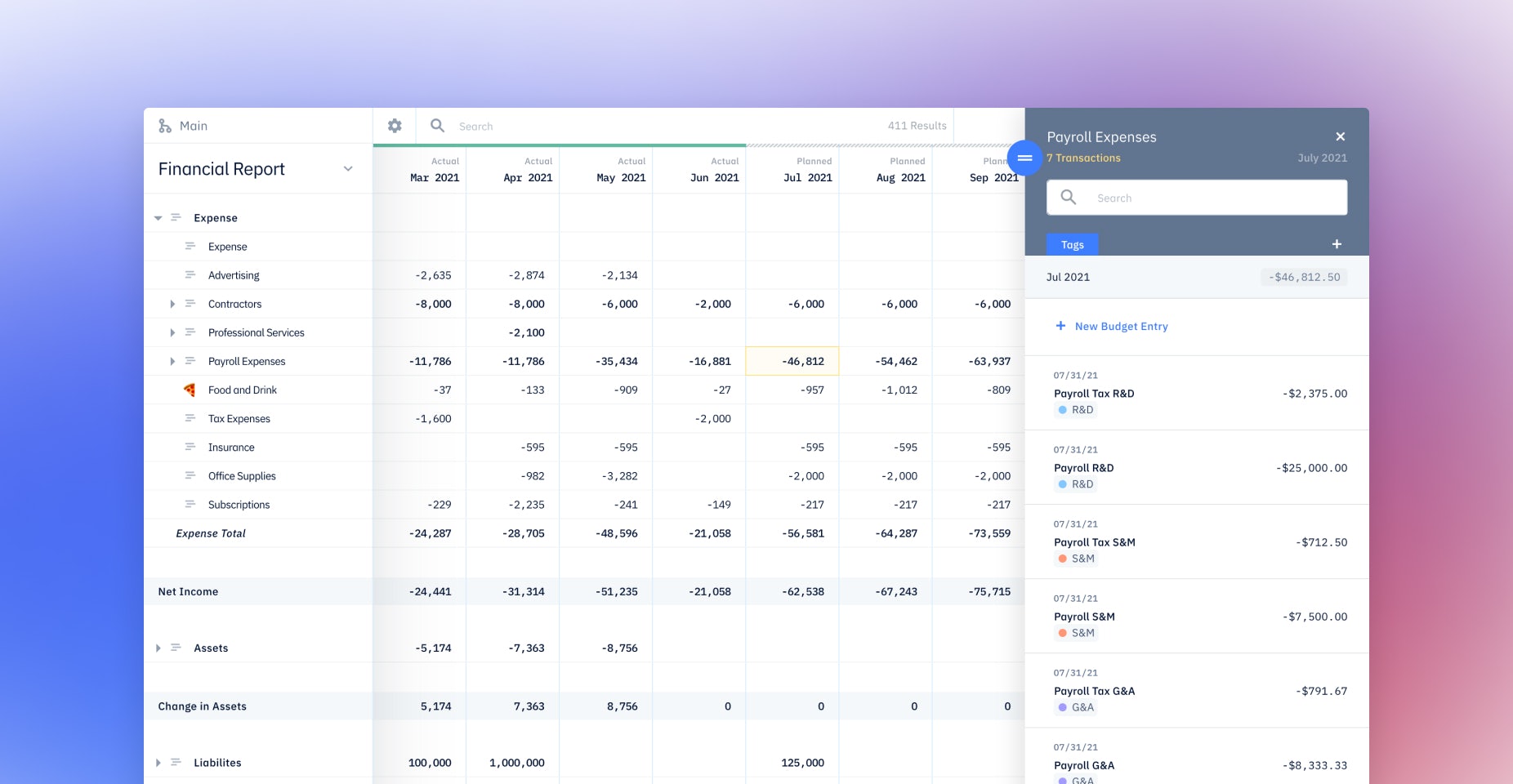

Why Do Startups Need to Departmentalize Expenses?

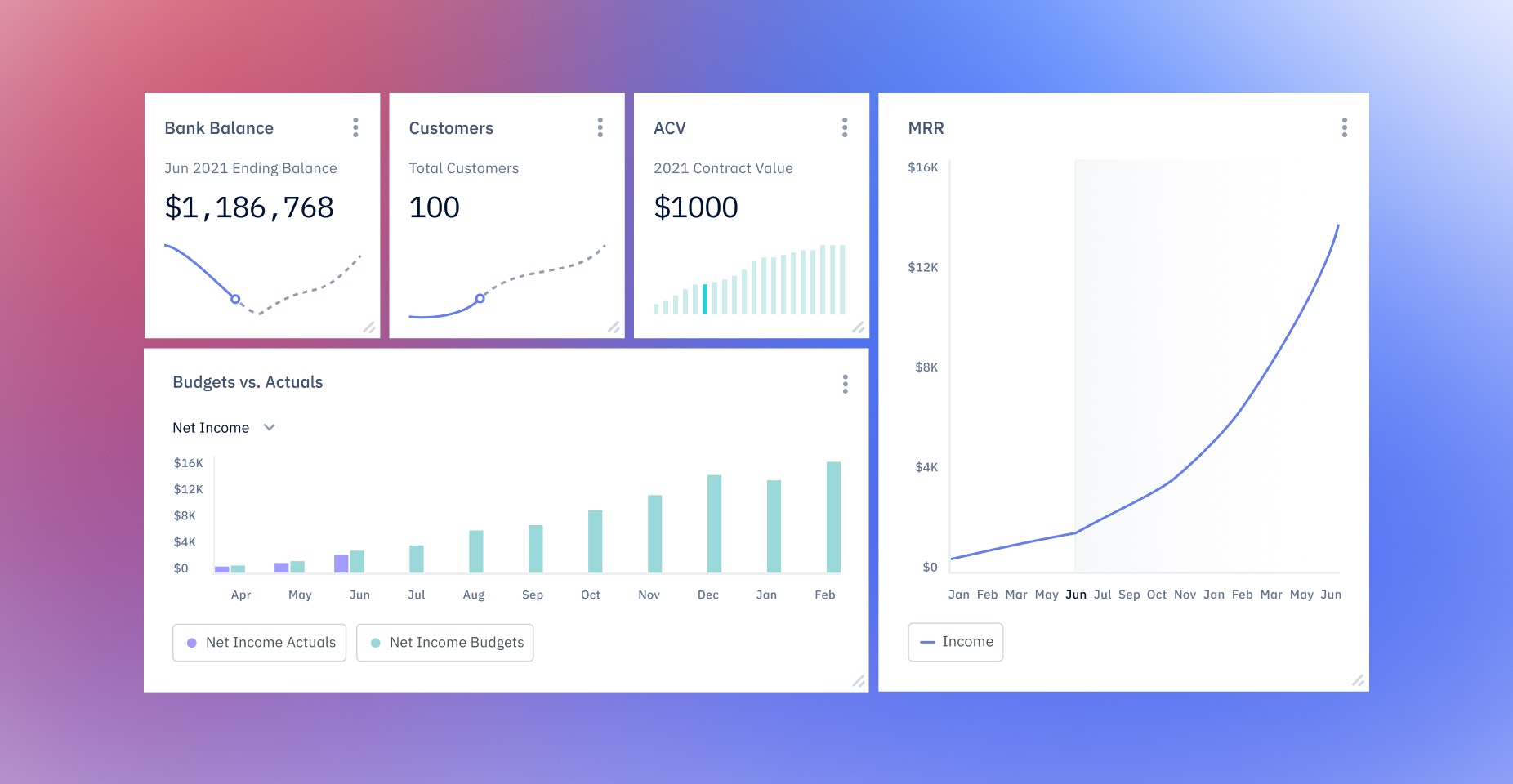

Using software to departmentalize expenses helps you avoid lumping all expenses together. Categorizing your expenses by departments can give you a granular view of your startup outflows. It can help you benchmark your startup against industry peers, set department budgets, and make more informed financial decisions.

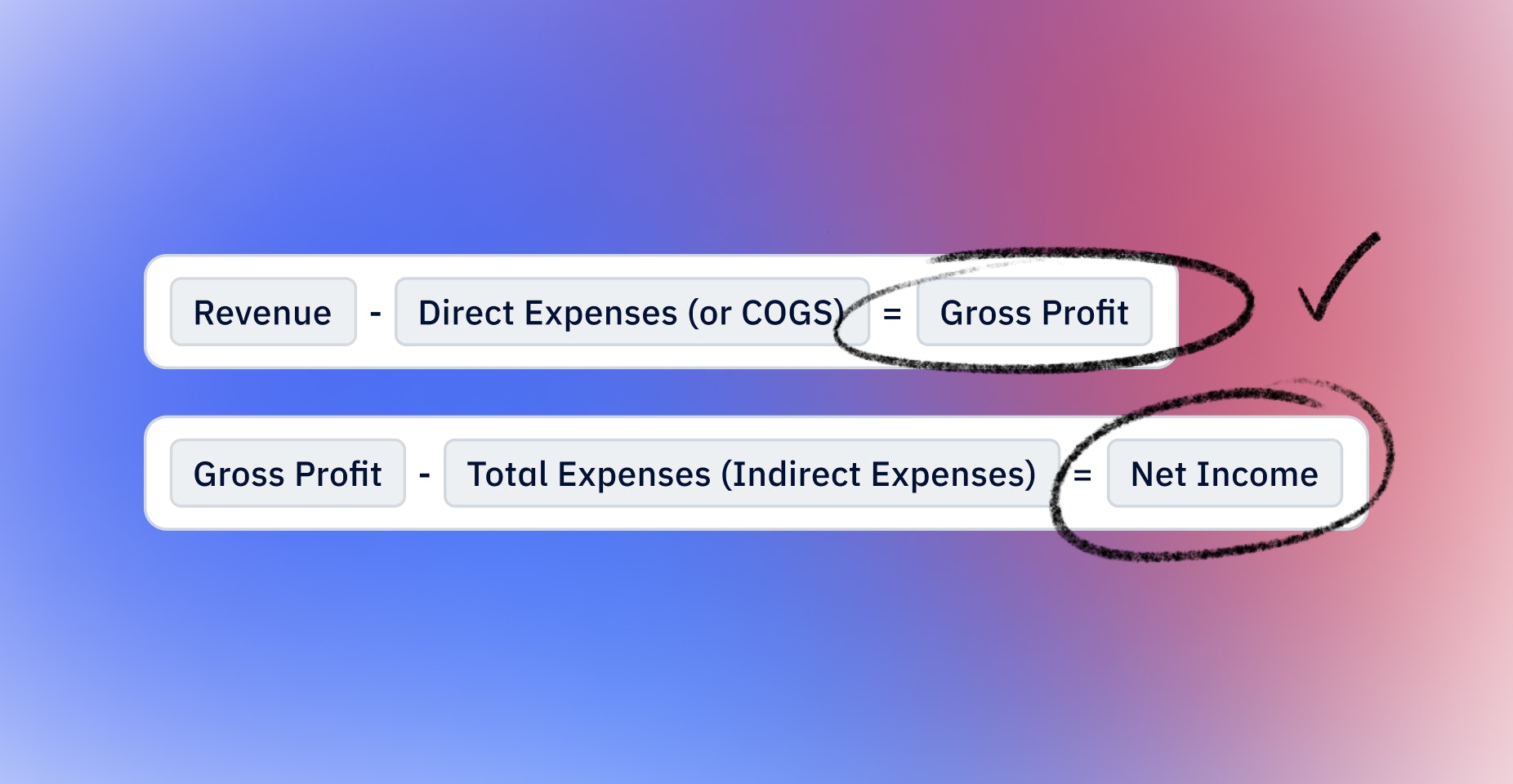

Understanding Your Bottom Line: Gross Profit vs Net Income

As a small business owner or startup founder, you’re going to come across different measures of profitability when looking at your company’s income statements. Two of the most important measures to look at are gross profit and net income. Confusing gross profit with net income or vice versa can skew your view of your company’s financial health. Understanding what each of them signifies, on the other hand, enables you to make the right decisions for your business based on facts, not fantasies.

How a startup on a mission to transform hiring beat ‘spreadsheet anxiety’ and mastered financial planning

As the Guide team emerged from stealth and began to execute aggressively on a vision to revolutionize the interview experience, they fought to organize their finances and keep tabs on fundraising.

A Brief Guide to CAC Payback and How to Calculate it

They say you’ve got to spend money to make money, but they don’t say how much you have to spend...or how long you have to wait to get it back. That’s where CAC (customer acquisition costs) and CAC payback come into play. CAC payback is a crucial metric for early startups because it helps founders understand their sales efficiency and profitability. It answers the question When will we see the money we’re spending to get customers to come back to us?

First what-if analysis? Here's how to create one

Creating a what-if analysis is crucial to good decision-making because it allows you to see the outcome of any given scenario when you change certain variables. It exposes which factors might put your company at risk, so you know where to put your focus. It also fosters investors’ trust because it proves out the ROI of their investment. You should perform a what-if analysis before making any major decision.

How a startup at the intersection of four industries found a ‘one stop shop’ to plan its finances

As they gear up for an explosive year, “benefits for people without benefits” platform Catch.co is using Pry to model growth fueled by its different product lines.

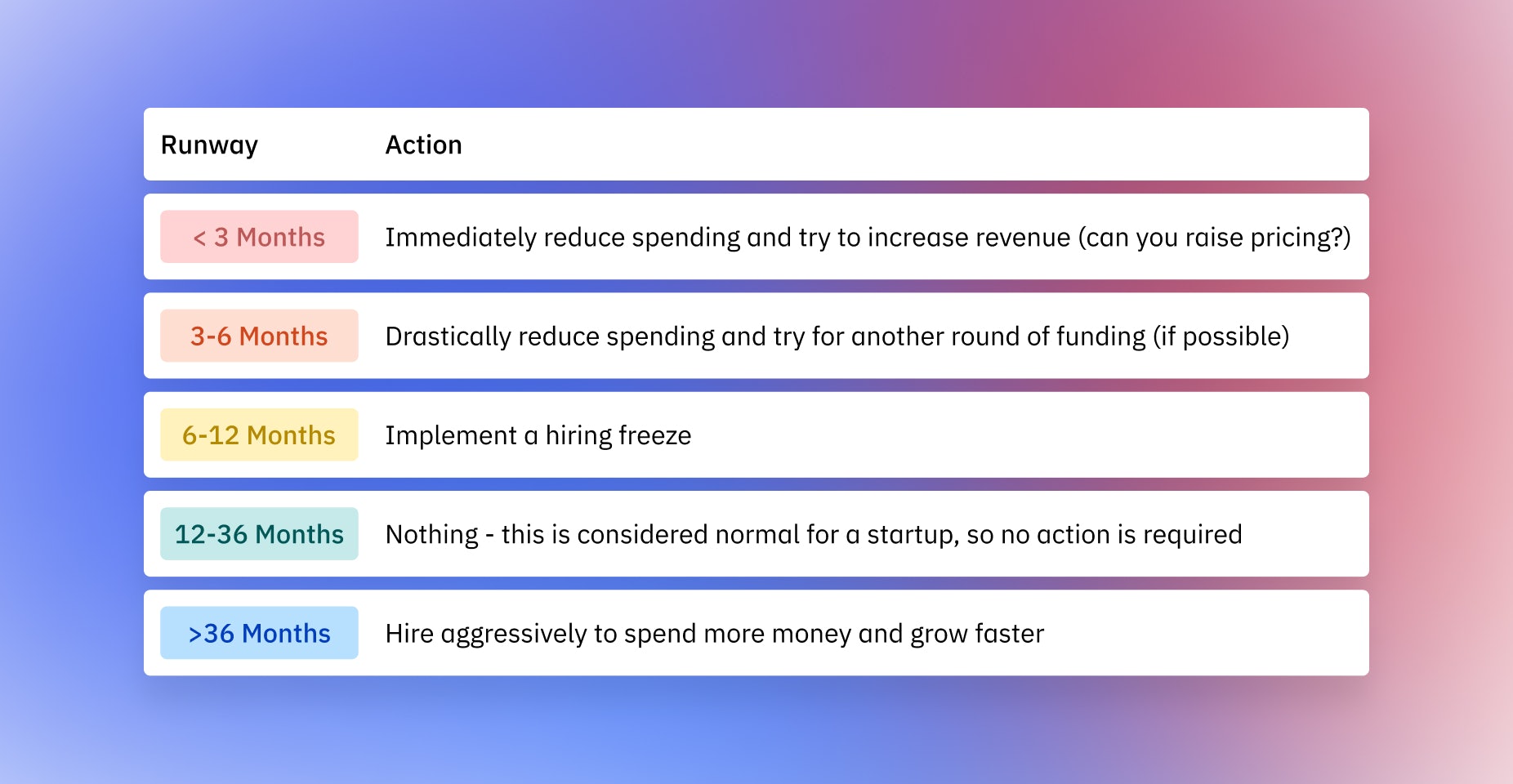

The Good, Better, and Best Ways to Calculate Startup Runway

If you know your runway will end in a couple of months, you obviously need to do something. You don’t want your company to crash and burn, and every potential investor will ask you about it. So you should be comfortable calculating and discussing your runway at any time.

Creating a Financial Plan for Startups: The Ultimate Guide

Creating a financial plan is essential to a startup’s success. For one thing, most investors need to see a startup’s financial plan before they even consider funding it. More importantly, a financial plan allows you to quantify your business assumptions, define specific benchmarks, plan for worst- and best-case scenarios, and measure your company’s success (even before you start making a profit).

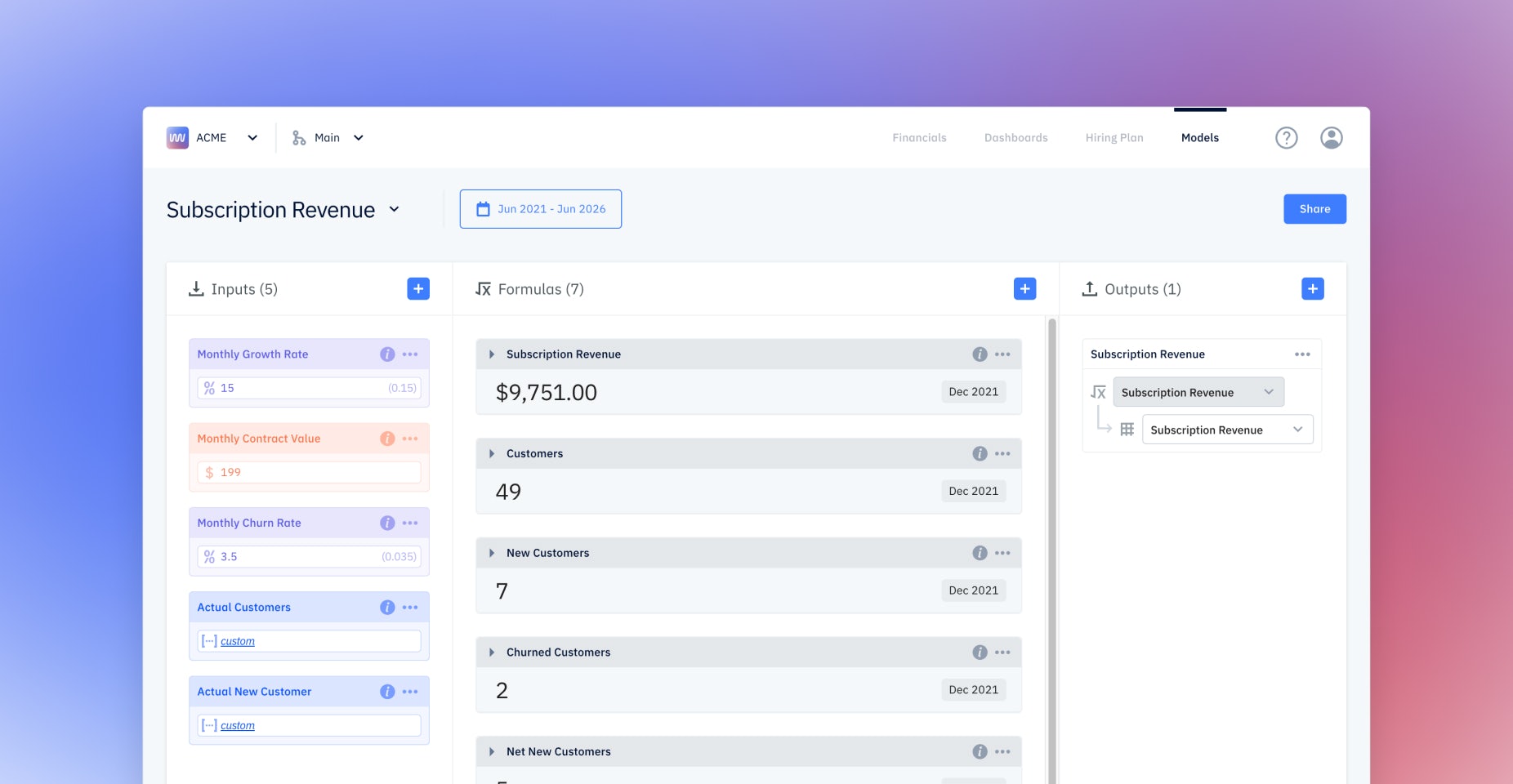

Revenue forecasting for founders: how to make projections early

Revenue forecasting is looking at existing data and predicting how much money your company will bring in from sales in future months, quarters, or years. Even early-stage startups need to track these metrics because accurate and realistic revenue forecasts are the only way you can avoid a big cash flow shortage and complete company meltdown.

For a Deep-Tech Startup Battling Blindness, Tracking Cash Runway is Part of the Mission

Quadrant Eye is a physician-led, seed-stage company with an offering that is fighting causes of preventable blindness

How a Marketplace Startup Made Their Financial Planning ‘Dead Simple’

After raising $2.5 million, and growing at a blistering rate, labor marketplace app Pangea needed a better way to compare its budget with real-time performance

The Nuts-and-Bolts Financial Planning Challenges Behind a Vision to Change the World

A company began to turn traditional charitable fundraising on its head, and then there was a problem: how will the accounting scale?

Clarity in Financial Planning Helped This Fast-Growth Cybersecurity Startup Navigate Strategic Decisions

Better insight into cash runway helped security startup Intruder move faster in hiring and scaling their operations.

How a 25+ Person Startup Expanding Globally Built a Customizable Hiring Plan in Seconds

After raising $27M in 18 months, emerging product-analytics company PostHog has moved quickly to scale its team and product

Announcing Pry’s $4.2m Seed Round

Empowering founders to make better financial decisions.

.jpg?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&lossless=true&max-w=1280&q=65)